jersey city property tax

Online Inquiry Payment. Hudson County NJ Property Tax Information.

|

| Appealing Your New Crazy Jersey City Property Tax Bill Jersey City Passaic County Divorce Family Law And Criminal Law Attorneys |

Jersey City Mayor Steve Fulop speaks at a June 16 event in Journal Square.

. Why is Mayor Steven Fulop responsible for your 1000 property tax increase. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. The new school tax rate is about 087 and the new city tax rate is about 082 these rates are computed by dividing the new levy for each government into the 2022 tax base. The estimated tax levy will see about 45 percent of it at 352 million going to the school district.

How much are Jersey City property taxes. The average tax rate in Jersey City New Jersey a municipality in Hudson County is 167 and residents can expect to pay 6426 on average per year in property taxes. While Jersey City has the lowest property tax rate in Hudson County with a General Tax Rate of 161. Mayor Steve Fulop hailed the news on Twitter.

TAXES BILL 000 000 49425 0 000 2036. Jersey City homeowners who were whacked with a whopping third-quarter property tax bill should brace for another stinging blow in the final quarter of 2022. The Tax Collectors office is open to the public from 900 430 pm each business day. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Tax Map Viewer Application. Municipality 2021 General Tax Rate 2020 Average Tax Bill. 2178 million will be for the city and 1849 million is for Hudson County. For the past 4 years Ive been researching and writing about property taxes and revaluation among other topics on CivicParent.

Tax amount varies by county. The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents. Property Taxes can be paid in person by mail or paid online. 189 of home value.

The average New Jersey property tax bill in New Jersey was 9284 in 2021 among the highest in the nationRough figures from the ANCHOR program average a 971 annual. In the past year Ive also written about tax. In a letter accompanying the quarterly tax bill Fulop absolved himself from responsibility for the property. New Jersey has the highest property taxes in the country.

Interest in the amount of 8 per annum is charged on the first 150000 of delinquency and. Civil Solutions has designed and maintains the Jersey City Tax Map Viewer Application for informational purpose. JERSEY CITY NJ 07302 Deductions. Anchor Property Tax Benefit Program.

Jersey Citys residents have struggled greatly with three main core issues embraced and. Jersey City establishes tax levies all within the states statutory rules. 11 rows City of Jersey City. Civil Solutions is the dedicated Geospatial.

This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and. Jersey City Property tax payments received after the grace period interest will be charged. Send your check or.

|

| U S Cities With The Highest Property Taxes |

|

| Loew S Theatre In Jersey City Approved To Receive 42 27m In Tax Credits From Njeda Roi Nj |

|

| New Jersey Education Aid Jersey City S Property Reassessment Won T Change State Aid |

|

| Jersey City Property Tax Wayfair |

|

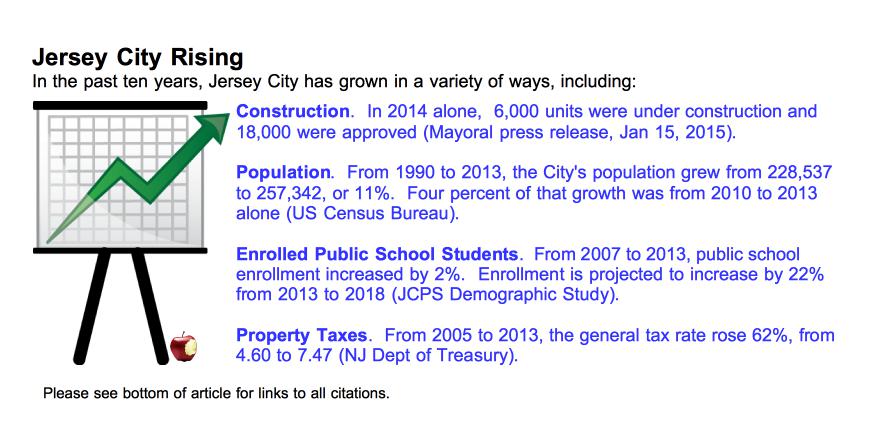

| Infographic Jersey City Tax Base Tax Levies And Tax Rates Demystified Civic Parent |

Posting Komentar untuk "jersey city property tax"